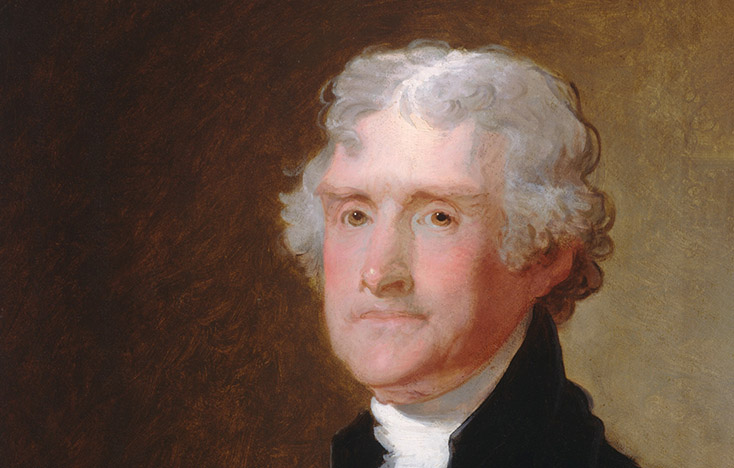

What Can Thomas Jefferson Teach Us About Estate Planning?

What can Thomas Jefferson teach us about estate planning? Despite being a brilliant intellectual and the principal author of the Declaration of Independence, Jefferson nevertheless struggled to manage his financial affairs during life. In addition, he was saddled with debts that were inherited from his family and also one that he had assumed by cosigning on a loan for a friend who died prematurely.

When Jefferson passed away, he still had significant debts that his family had to repay. Because Jefferson had valuable real property but very little liquid cash with which to pay his debts, his executor ultimately had to sell the family land at depressed market prices to raise enough cash to pay his debts. The unfortunate result of these circumstances was that very little of Jefferson’s property was able to be passed down within his family.

Many families today face similar problems with their estates. This issue arises most often when a business has significant wealth tied up in their business or land but little cash in reserve to settle debts or pay transfer taxes at death. This can cause the families left behind to feel intense pressure to sell the business at significantly less than they might otherwise be able to sell it for under better conditions in order to raise the cash necessary to pay the debts or taxes that will shortly come due.

Life insurance is an important estate planning tool often used to provide sufficient cash to pay a deceased individual’s debts or transfer taxes. With the proper type and amount of life insurance, and by using certain estate planning tools such as irrevocable life insurance trusts, an individual can prevent a “land rich, cash poor” situation like that experienced by Thomas Jefferson’s family.

Now that you know about Thomas Jefferson’s financial situation, we hope that you will think about your own estate planning and what you might want to do differently going forward.